“What would investment into communities look like if those very communities were part of the process?” This question lies at the heart of a new report released today by Transform Finance. A year into a pandemic that has devastated small businesses, especially in BIPOC communities, a timely new report by Andrea Armeni and Curt Lyon, titled Grassroots Community Engaged Investment, looks at how grassroots community groups can design investment strategies to meet their needs.

There have certainly been other community investing reports; last year, NPQ covered one published by the National Coalition for Community Capital (NC3) and the Solidago Foundation that featured some of the same funds profiled by Armeni and Lyon. What makes the new report unique, however, is its focus on community voice and governance rather than on investment terms. Building on multiple case studies, the authors encourage mission-aligned community investments “to reckon with and experiment with the sharing of power and the intentional re-centering of communities.”

So, what is the state of community investment from the perspective of community voice and governance? The word “experiment” is a clue and speaks to the tentative nature of many efforts. Not every effort is new, however. Indeed, one of the profiled case studies dates back to the 1990s. These earlier cases provide lessons, both positive and negative, that can inform the newer efforts.

What is Grassroots Community Engaged Investing?

For their report, Armeni and Lyon coin the phrase “grassroots community engaged investment” or GCEI. The phrase may not roll off the tongue, but it emphasizes, as their report subtitle puts it, the importance of “redistributing power over investment processes as the key to fostering equitable outcomes.”

Armeni and Lyon describe GCEI as a “power-building approach to investment.” By this they mean that investment is made in service of a broader community-building agenda. This approach, they contend, connects social justice movements to capital, builds community knowledge regarding local economic ecosystems, and funds projects that are “supported by and reciprocally support existing movements in the community.”

Too often, Armeni and Lyon contend, mission-oriented nonprofits like community development financial institutions (CDFIs), credit unions, and community development corporations (CDCs) fail to fully involve community members in their investment decisions. The results can lead to investments that are made for but not with the community. For local grassroots groups, this can feel like “the same kind of absenteeism that the less impact-oriented investors have.”

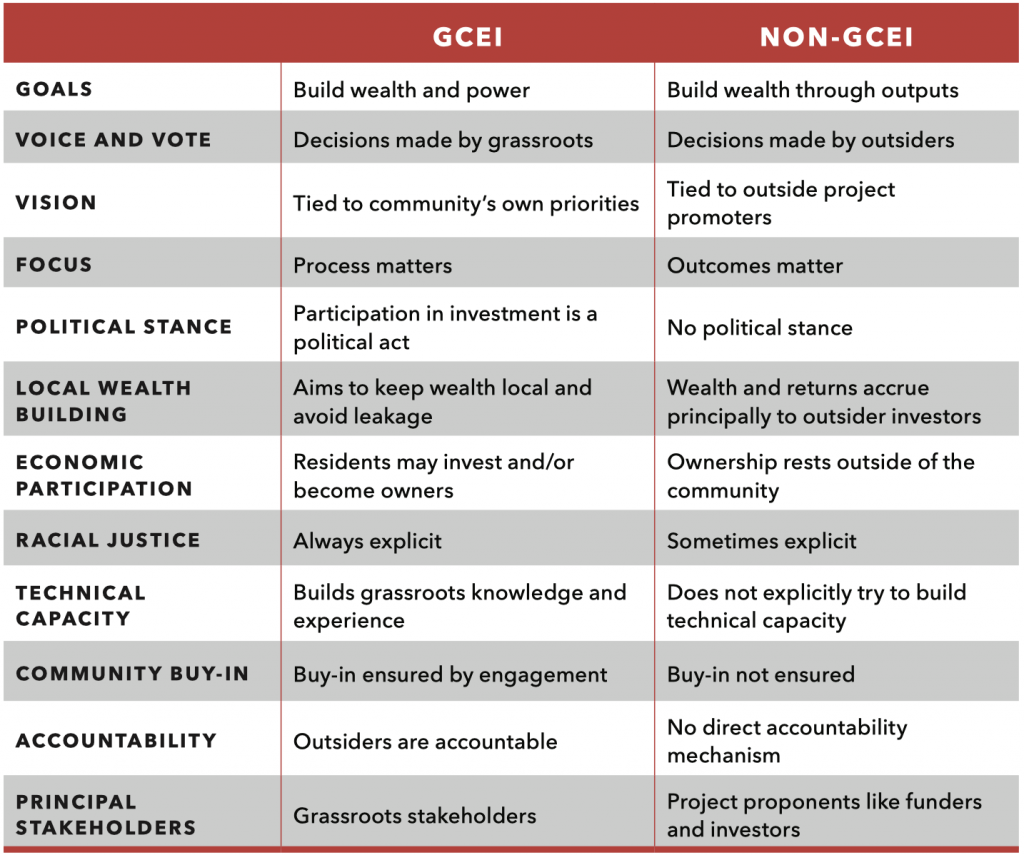

In the chart below, Armeni and Lyon contrast how a grassroots-oriented approach (GCEI) differs from what they portray as standard impact investing:

The preceding chart should be read with caution. What it lays out are ideal types rather than precise descriptions. Quite clearly, many CDCs and CDFIs were formed by community groups that were motivated by racial justice and a power-building vision, even if they have moved over time in the direction of professionalization. And while many grassroots efforts devote considerable energy to democratic process, they care about results (outcomes) too.

That said, the tension Armeni and Lyon lift up is a real one. As I wrote in NPQ back in 2019, such “tensions between day-to-day operations and long-term vision” are common; “this is not to excuse every compromise made, but it is to acknowledge the challenge inherent in any work that seeks to promote even modest structural economic change.”

Grassroots Community Investing: Real World Examples

Armeni and Lyon build their case by drawing on 16 organizations. Eight of the profiled groups are loan funds—three locally based, two regionally based, and three national funds. Of the national funds, both the Olamina Fund and Seed Commons support local lenders, which in turn lend to BIPOC-owned businesses (or, for Seed Commons, specifically worker cooperatives). ROC USA, by contrast, provides loans to finance resident purchases of manufactured housing communities (mobile home parks). A list of the eight funds is below:

| Name | Geography | Focus & Size | Founded |

| Boston Impact Fund | Boston, MA | Small business, $6 million | 2017 |

| Boston Ujima Fund | Boston, MA | Entrepreneurs of color, $2 million to date | 2018 |

| Co-op Capital (originally La Montañita Fund) | New Mexico | Micro-lending, $1.2 million | 2010, expanded in 2016 |

| Invest Appalachia | 6-state region | $57 million business fund | 2019 |

| Olamina Fund | National | $40 million fund, BIPOC businesses | 2019 |

| Resident Owned Communities USA (ROC USA) | National | Resident- owned mobile home parks, $65 million | 2008 |

| Revolutionary Economy for All Local (REAL) People’s Fund | Oakland, CA | $1.5 million to date, BIPOC businesses | 2020 |

| Seed Commons | National | $7.8 million, worker co-ops | 2015 |

The remaining eight efforts focus on some form of community land-use planning, although the focus of the projects varies widely from housing to ownership of shopping malls to, with Thunder Valley Community Development Corporation, the master planning of an entire sustainable community.

A list of these eight projects is below:

Sign up for our free newsletters

Subscribe to NPQ's newsletters to have our top stories delivered directly to your inbox.

By signing up, you agree to our privacy policy and terms of use, and to receive messages from NPQ and our partners.

| Fund Name | Location | Focus | Founded |

| Downtown Crenshaw | Los Angeles, CA | Commercial center | Seeking site control |

| East Bay Permanent Real Estate Cooperative (PREC) | Oakland, CA | Housing | 2017 |

| East Portland Community Investment Trust | Portland, OR | Commercial center | 2010 |

| Elevated Chicago | Chicago, IL | Community planning | 2017 |

| Kensington Corridor Trust | Philadelphia, PA | Commercial corridor | 2017 |

| Market Creek Plaza | San Diego, CA | Commercial center | 1998 |

| Thunder Valley Community Development Corporation | Porcupine, SD (Lakota Nation) | Community planning | 2007 |

| Tribune Building | Wisconsin Rapids, WI | Mixed-use building | 2012 |

What Do Grassroots Investing Practices Look Like?

As Armeni and Lyon make clear, like participatory grantmaking, grassroots investing practices vary a lot. Nonetheless, some core practices can be identified.

Governance: Some funds place borrowers and/or community organizations directly on their boards. Others, particularly when the fund or project is shepherded by a larger organization, don’t do this, but similar to some participatory grantmakers, these larger sponsors often empower community partners to make decisions regarding who gets lending and technical assistance support.

Design: Many initiatives, especially those involving real estate, place a high degree of emphasis on co-designing with the public. For instance, more than 2,000 Wisconsin Rapids residents participated in design meetings for the Tribune Building project.

Ownership: Many of the initiatives profiled enable community members to literally “buy in” and become shareholders or small depositors, thus sharing in the wealth generated. For instance, in Portland, members of East Portland Community Investment Trust can invest as little as $10 per month, which earns a mandatory minimum dividend of two percent. Actual dividends were 9.6 percent in 2018 and 8.9 percent in 2019.

Ownership can be individually based, but it can also be community based. East Bay PREC, for instance, owns land as a cooperative. Downtown Crenshaw is attempting to buy a shopping center. These projects, note Armeni and Lyon, create the kind of financial power that can reinforce the community organizing power of grassroots groups. This kind of investment, they observe, “builds channels for grassroots voices to continually contest for power in their ecosystem and sets precedents that can be built around for long-term financial alignment with grassroots movements.”

Challenges and Successes

Among the profiled real estate projects, Market Creek Plaza in San Diego, California, is the oldest. The fact that a $23.7 million redevelopment project founded in 1998 is still standing in 2021 shows that grassroots investment can achieve lasting effects.

To raise that $23.7 million required a mix of philanthropic, private, and public support. What was once a “20-acre toxic-ridden factory site” became a shopping center. Not only that, but residents became co-owners, with 415 people buying a total of $500,000 worth of shares, collectively holding a 20-percent share. Another 20-percent share is held by a local neighborhood-based foundation. Because only people with direct neighborhood ties could buy in, 78 percent of individual shares were purchased by Black residents and another 11 percent by Latinx residents.

However, as Armeni and Lyon detail, many aspects of the community plan did not get realized. A later phase of the project got cancelled due to a withdrawal of state and private funds during the Great Recession, and the vision of a center filled by local businesses gave way to one served mainly by chain stores. Market Creek has clearly been an economic success, employing hundreds of local residents of color, but the project was less transformative than envisioned.

The longest lasting loan fund profiled by Armeni and Lyon is ROC USA, a loan fund that, as NPQ has covered before, has been spectacularly successful. ROC USA specializes in helping residents of mobile home parks secure their tenure by owning the land beneath their homes. By 2020, ROC USA had helped 18,000 families in 264 communities in 18 states secure land ownership. Once land ownership is secured, as with any co-op, residents elect the local co-op board. There are also three resident members on the 15-person national ROC USA board.

The group, write Armeni and Lyon, “provides clues as to the multi-faceted approach needed to empower communities and generate broad-based ownership over capital decision making. They sought funding from many national funders and mission-aligned lenders, established a strategy for partnerships with local lenders and developers, built a nonprofit and CDFI to most efficiently channel resources to communities that needed it most, while maintaining avenues for governance from those closest to the ground.”

A Growing Movement

While examples like Market Creek and ROC USA show staying power, many of the examples are much newer, speaking to the proliferation of grassroots community investing efforts. For grassroots community investing, this is a moment of both much promise and peril. On the promising side, there has been a rapid spread of knowledge of how to structure funds and projects to achieve greater grassroots democratic control. Regarding the Boston Ujima Project, for instance, Armeni and Lyon cite its trailblazing system of interlocking member committees and assemblies, writing that, “It seeks to build not just wealth, but power, and transform the local ecosystem to meet the needs of the BIPOC and working-class people who make up its membership. At the same time, they note that “individual decisions can take weeks to come to.”

While process is important to grassroots community investment, getting results matters too. In their section on “takeaways” regarding scaling and replicability, the authors acknowledge that most community projects remain small, observing that some funds “have fairly restricted pipelines given the strict mission criteria of the grassroots stakeholders leading them.”

Building out the field, Armeni and Lyon add, will require patience and continued innovation. Among their lingering questions: “How can one reconcile the tensions between power shifting and more traditional investment decisions? How can grassroots leaders be supported and resourced to build?”

On a more positive note, Armeni and Lyon point out that the shift to grassroots community investment has gotten a major boost due to rising movements for racial and economic justice. This portends a likely expansion of these efforts in the years to come. As Armeni and Lyon detail, “The orientation towards the role of investors and funders in driving social justice is shifting.” This in turn has led to deepening conversations “among frontline activists, BIPOC communities, and others most affected by economic crises—about how to center the voices of people harmed by systems in changing those systems.”